INTRODUCTION

- On the 2nd of April 2025, President Trump announced sweeping tariffs on all goods imports into the United States.

- Practically this means that all countries are facing at least 10% US import tariffs, with many facing far higher percentages.

- In addition to these “reciprocal tariffs”, imports from all countries will face blanket 25% US import tariffs on steel, aluminium and automotive imports.

- The UK is not exempt, though has the lowest reciprocal tariff percentage at 10%. Particularly impacted sectors are automotive and steel, which face the higher 25% tariffs. Key sectors without direct impacts are pharmaceuticals and services – which are both exempt from tariffs.

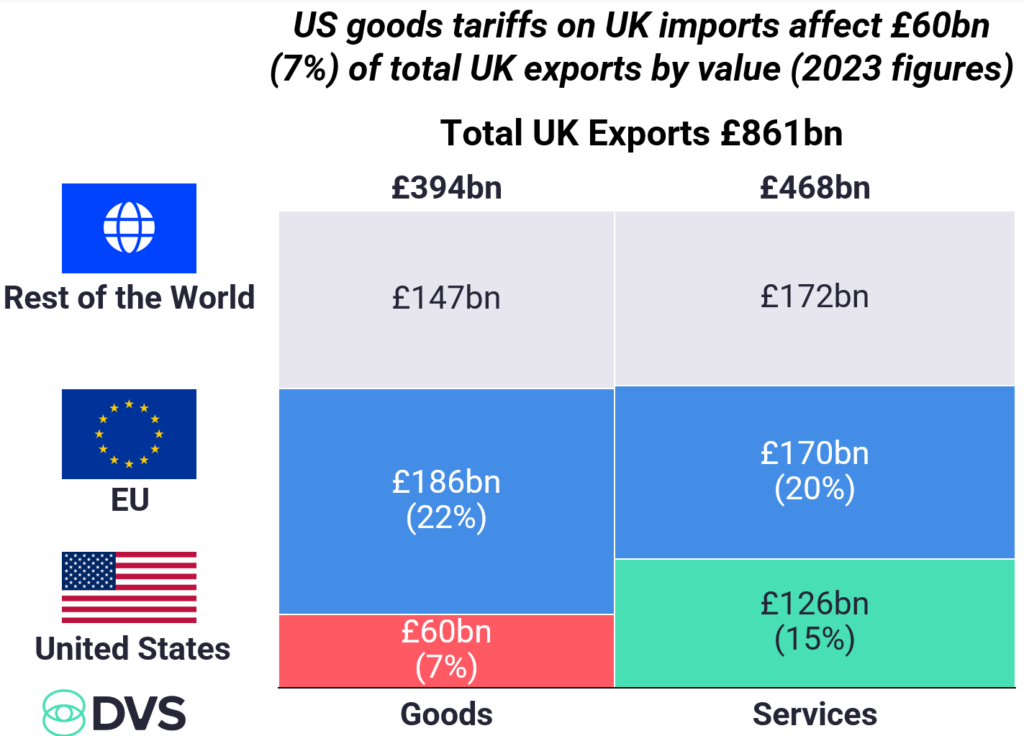

7% of overall uk exports are impacted

- The tariffs only impact goods. Where US bound exports make up 7% (£60bn) of overall UK exports (£861bn) and 15% of goods exports (£394bn). 2023 Figures

- Critically, these tariffs do not impact services exports (and thus the large financial and professional services industry in the UK) – where the US is an even more signficant market than it is for goods.

iNDUSTRIES ARE NOT EQUALLY IMPACTED

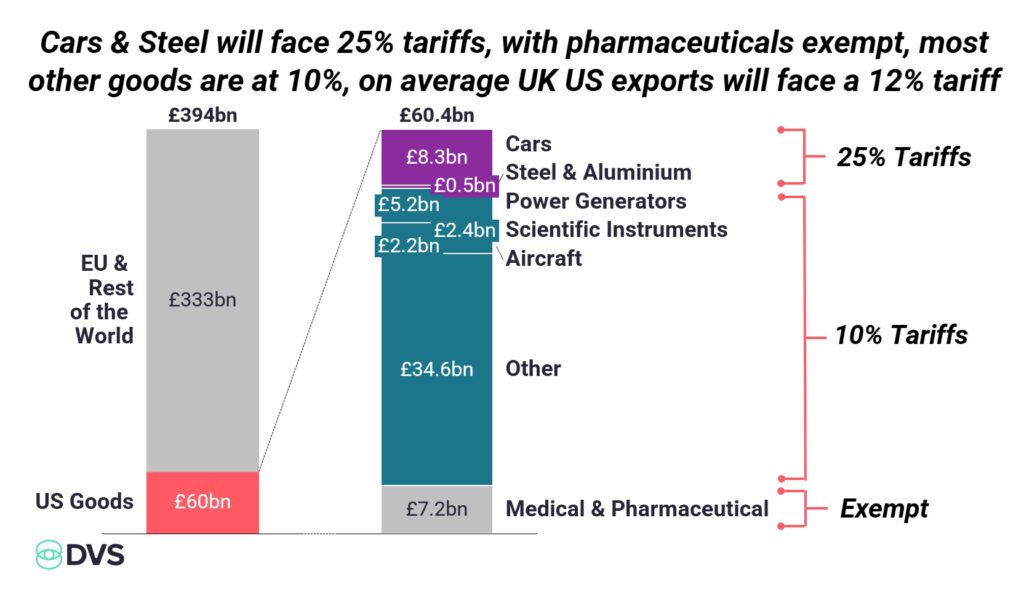

- Within goods exports, not all industries are subject to the 10% tariff – with some facing 25% tariffs and some exempt.

- Automotive, steel and aluminium exports to the US are subject to the higher 25% tariff.

- There are 0% tariff exemptions for pharmaceuticals, semiconductors, lumber, copper, gold, energy resources and selected minerals not available in the US.

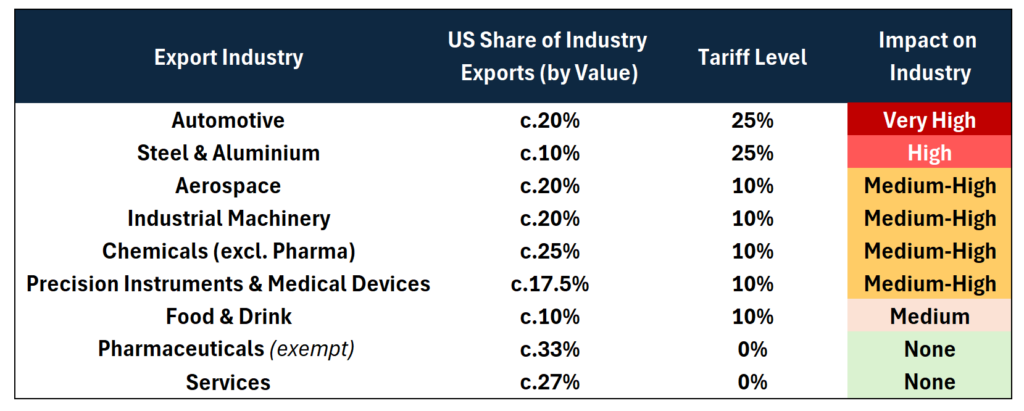

- The worst impacted industries are those both with high exposure to the US market and high tariffs like automotive and steel, but also aerospace, chemicals, machinery and precision instruments.

- Where the automotive sector is clearly exposed with one in eight UK made passenger cars (and 20% of value) being exported to the US.

- Research by the University of Birmingham calculates that the impact to UK GDP will be £10bn between 2025 and 2030, with 137,000 jobs at risk. 85% of this impact is expected to be felt in the West Midlands and North West, impacting British brands like Jaguar Land Rover and Aston Martin.

Where are we going from here?

- There are early signs that the UK may eventually be able to negotiate favourable exemptions from some of these tariffs, coming from both White House and Downing Street insiders. Though there are no active or official announcements to this effect.

- There are likely to be further second and third degree consquences to these actions, as they meaningfully shift global supply chains and international trading relationships, with follow on impact to the UK. The exact form of these is hard to forsee.

- It is possible that the UK might gain competitive advantages in some sectors e.g. Scotch versus Irish whiskey in the US market (10% vs 20% tariffs) or UK versus US services in the EU market (especially if the EU follows through with reciprocal tariffs targeting US services.

- Tariffs will directly impact profit margins and sales volumes in the US market for impacted products, and other than reprioritising to new markets or relocation production to the US, there is little that impacted firms can do to mitigate these impacts.

Commentary, News, Politics

Sweeping US Tariffs: What This Means for the UK

INTRODUCTION

7% of overall uk exports are impacted

iNDUSTRIES ARE NOT EQUALLY IMPACTED

Where are we going from here?

Related Posts

AI Enrichment Tool: Enabling B2B SaaS Value Creation

From data to decisions: what sets leading RevOps teams apart

Enabling accurate historical reporting through a customer cube audit

Building a strategic expansion plan for a leisure chain looking to enter new markets

Extending planning horizons through core reporting

Capability Build – Implementing an Updated Discount Strategy for a Retailer